Source: Ukragroconsult (Ukraine)

The profit decline affecting major global agricultural products traders may worsen as food inflation, which has helped lift profits to record levels in recent years, eases, UkrAgroConsult reported, citing Bloomberg.

Archer-Daniels-Midland Co. and Bunge Global SA are expected to report their worst second quarters in four years, with profitability declining in most of their businesses, Bloomberg estimates.

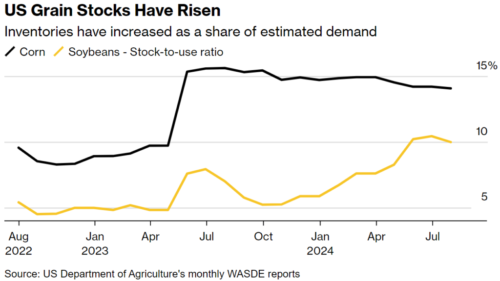

Markets saw a sharp reversal after crop losses and farm supply shortages caused by the war in Ukraine drove grain prices to the highest since 2022, giving agribusinesses excess profits. Soybean, corn and wheat futures fell as production resumed, reducing buyers’ desire for a secure supply and making farmers reluctant to sell their produce. Price volatility has also weakened, making it harder to profit from trade.

“The environment for processing and selling agricultural products has changed, especially in the second quarter of 2024 compared to recent years. The premium these companies receive for selling their products globally has decreased,” said Citigroup Inc.

ADM is expected to report earnings of $1.24 per share for the second quarter of 2024, down 34% from the second quarter of 2023 and the lowest since 2020 for the same period, according to average estimates compiled by Bloomberg. Bunge’s earnings per share fell 48% to $1.92, the lowest since Q1 2020.

ADM is the “A” company and Bunge is the “B” in the storied foursome of ABCD traders that have dominated grain markets for more than 100 years. Their rivals Cargill Inc. and Louis Dreyfus Co – “C” and “D” – belong to companies that are owned by individuals and do not report profits.

Investors will be watching closely for Bunge’s updated outlook on the completion of its $8 billion acquisition of Viterra. Bunge’s shares are up about 13% in 2024, while ADM is down 11%.

In addition to the change in grain prices, traders are suffering from the fact that profits from processing soybeans into meal and oil, a key profit driver, have declined.

The expansion of refining capacity in the US has been accompanied by a slowdown in oil demand for renewable diesel. This was partly due to an increase in US imports of alternative feedstocks such as used cooking oil and beef fat. The resumption of supply in Argentina, a major exporter of soybean oil and meal, following the drought in 2023 also impacted margins.

Corn ethanol profits in the US were also significantly lower in the second quarter of 2024, according to Bloomberg data, which had a negative impact on ADM in particular.

Bunge and ADM’s profits have beaten analysts’ average estimates almost every quarter in recent years. US soybean processing profitability began to improve in June 2024 as soybean farmer sales in Argentina were lower than expected and some US processors were able to start processing earlier than usual due to seasonal maintenance. This opened up the prospect of a further yield increase in the second quarter of 2024, pointing to a stronger second quarter.

The improved outlook prompted analysts to raise their full-year earnings forecast for Bunge to an average of $9.54 per share, up from $9.39 per share in June. This compares to earnings of $13.66 per share in July 2023.

Prospects for another bumper crop of US soybeans and more new processing capacity by 2025 mean the recent improvement in profitability may be short-lived.